Exclusive Benefits for Costco Members

Exclusive Benefits for Costco Members

We offer exclusive financial solutions designed specifically for our valued Costco Members. Plus, Costco Executive Members earn a Costco Shop Card for all settled loans!

Discover the benefits that await you and elevate your loan management journey with Manage Your Loans.

We offer exclusive financial solutions designed specifically for our valued Costco Members. Plus, Costco Executive Members earn a Costco Shop Card for all settled loans!

Discover the benefits that await you and elevate your loan management journey with Manage Your Loans.

We redefine the lending experience by putting you, our customer, at the heart of every decision. Our dedicated team not only equips you with invaluable insights throughout your loan journey but also ensures that you are empowered to make informed decisions.

Request a Call

Error: Contact form not found.

Home loans that are right for you

Personal Loans with you in mind

Asset finance that works for your business needs

Commercial loans to grow further

Support on every step of the process

Empowering you to make informed decisions

Experienced team to guide you

Technology -based loan process

Start your financial journey now

First Home

Venturing into the world of homeownership for the first time?

Turn your dream home into a reality.

Next Home

Ready for a change? Whether you're upsizing, downsizing, or just seeking a new scene, we are here to simplify your next move.

Refinance

Feeling the pinch of current mortgage rates or terms not aligning with your financial goals? It might be time for a change.

Investment

Are you an investor looking to maximise returns on your property investment? Invest smarter, not harder.

Personal Loans

Consolidating debt, planning a dream vacation, or tackling unexpected expenses, achieve your personal financial goals.

Business Finance

Thinking of taking your business to the next level? Take the guesswork out and cut through the red tape and complex jargon.

Asset Finance

Whether it's upgrading machinery, purchasing software, or expanding operations, let us help you turn your business dreams into reality.

Car Loans

We make securing a car loan smooth. Gear up for your next big adventure and take the wheel of your next car with confidence.

We are proud to announce our strategic alliance with Costco, a brand renowned for its commitment to quality, value, and customer satisfaction.

This partnership amplifies our shared ethos of placing customers at the heart of our operations.

Beyond our commitment to simplifying the loan management process, Manage Your Loans offers tailored loan solutions and an expedited application process.

Moreover, our collaborative initiatives with Costco ensure that members are empowered with knowledge-driven finance tools, making their journey not just about acquiring a loan but about making well-informed financial decisions.

As always, our goal is to offer transparency, convenience, and a seamless experience, now further enhanced for the esteemed members of the Costco community.

Discover how premium member benefits meet unparalleled loan management expertise.

Costco Executive Members Benefits

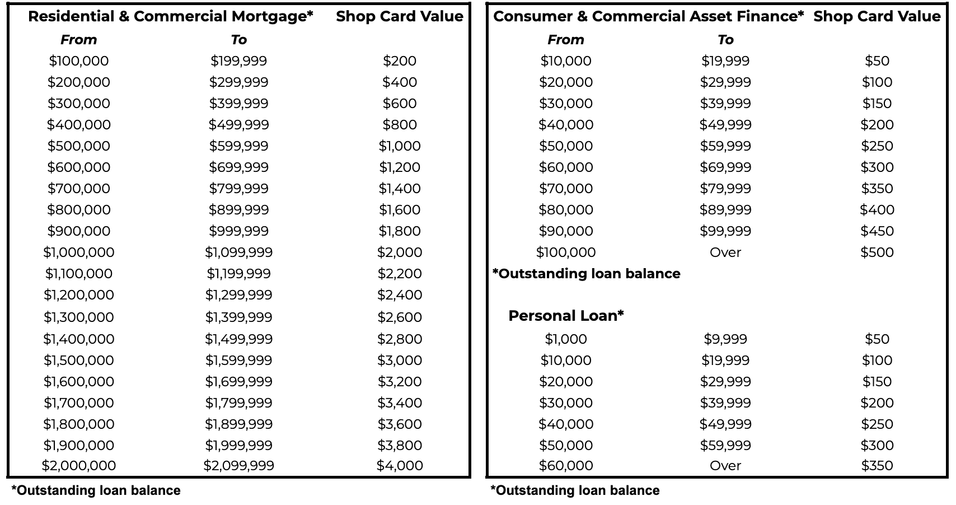

home & business loans

Secure a new or refinanced residential or commercial mortgage with us and get a reward!*

Find out how much you can get on your Costco Shop card for your Loan Amount:

*Terms and conditions apply.

^Loan Amount means the portion of the approved loan that is fully drawn down, excluding any funds sitting in offset or redraw accounts, as well as any undrawn amounts. For example, if you have a $600,000 loan settled, with $60,000 in redraw or offset, your loan amount would be the total loan settled less the redraw or offset $600,000 - $60,000 = $540,000. Please ensure that when calculating the amount of your Costco Shop Card reward, you are using the 'Loan Amount' and not total settled funds.

car & asset finance

Finance your car or business asset with us and, as a token of our appreciation, earn a Costco Shop card!*

Find out how much you can get on your Costco Shop card for your Loan Amount:

*Terms and conditions apply.

^Loan Amount means the portion of the approved loan that is fully drawn down, excluding any funds sitting in offset or redraw accounts, as well as any undrawn amounts. For example, if you have a $600,000 loan settled, with $60,000 in redraw or offset, your loan amount would be the total loan settled less the redraw or offset $600,000 - $60,000 = $540,000. Please ensure that when calculating the amount of your Costco Shop Card reward, you are using the 'Loan Amount' and not total settled funds.

personal finance

Secure your personal loan with us and enjoy an exclusive bonus*, as our way of saying thank you!

Find out how much you can get on your Costco Shop card for your Loan Amount:

*Terms and conditions apply.

^Loan Amount means the portion of the approved loan that is fully drawn down, excluding any funds sitting in offset or redraw accounts, as well as any undrawn amounts. For example, if you have a $600,000 loan settled, with $60,000 in redraw or offset, your loan amount would be the total loan settled less the redraw or offset $600,000 - $60,000 = $540,000. Please ensure that when calculating the amount of your Costco Shop Card reward, you are using the 'Loan Amount' and not total settled funds.

* Manage Your Loans Pty Ltd (MYL) ACN 652 442 790 Credit Representative (CR) 540988 provides access to Credit services via Home Mortgage Plus Pty Ltd ACN 105 991 839, Australian Credit License (ACL) 540988. A referral arrangement is in place between MYL and Costco; however, they are not otherwise affiliated in any other way. For terms and conditions on Costco Executive Members Shop Cards please visit www.costco.com.au/services.

Full terms and conditions, including relevant Costco Shop Card amounts & eligibility requirements

- You will not receive a Shop Card if the loan is not approved, not settled, not fully drawn down (including balances sitting in offset or redraw), or if a new loan is refinanced before the second anniversary of the original loan settled by Manage Your Loans, for which you have already received a Shop Card. Additionally, the value of the Shop Card will be based on the drawn-down amount of the loan. For example, if you take out a $600,000 loan and the balance of the loan is $540,000 with $60,000 sitting in redraw or offset you will only receive a Shop Card to the value of $540,000, or Loan amount approved less any undrawn, offset, or redraw amount will be the value the shop card is issued at.

Costco Offer Terms and Conditions

Costco Wholesale Australia Pty Limited ACN 104 012 893 (Costco) and Manage Your Loans Pty Ltd ACN 652 442 790 (MYL) have established a referral partnership.

Commissions and Costco Shop Card

Costco may receive a commission when you obtain a loan through MYL. To benefit our valued members, Costco will transfer this commission amount in full to eligible members in the form of a Costco Shop Card. The value of the Costco Shop Card varies based on the loan type:

- Residential Mortgages: See the table below.

- Commercial Mortgages under $1,000,000: See the table below.

- Commercial Mortgages equal to or exceeding $1,000,000: Up to 33% of the Net Earned Commission* received by Manage Your Loans. See the table below.

- Consumer and Commercial Asset Finance: Up to a maximum of $500. See the table below.

- Personal Loans: A maximum of $350 Costco Shop Card. See the table below.

Important - When calculating the amount of your Costco Shop Card reward, ensure you are using the ‘Loan Amount' or 'outstanding loan balance’ and not total settled funds. Loan Amount (outstanding loan balance) means the portion of the approved loan that is fully drawn down, excluding any funds sitting in offset or redraw accounts, as well as any undrawn amounts. For example, if you have a $600,000 loan settled, with $60,000 in redraw or offset, your loan amount would be total loan settled less the redraw or offset, $600,000 - $60,000 = $540,000.

*Commercial mortgages of $1,000,000 or more may provide a Costco Shop Card worth up to 33% of the Net Earned Commission received by Manage Your Loans if the commission from the Financial Institution is reduced to facilitate the loan for Costco Members through a Commercial Lender.

Eligibility and Terms

- To qualify for the Costco Shop Card, you must provide an active Australian Costco Executive Membership number at the time of application and the loan must be settled.

- Membership Status (Executive Membership) must be maintained at the time of issuance of the shop card.

- You will not receive a Shop Card if the loan is not approved, not settled, not fully drawn down (including balances sitting in offset or redraw), or if a new loan is refinanced before the second anniversary of the original loan settled by Manage Your Loans, for which you have already received a Shop Card. Additionally, the value of the Shop Card will be based on the drawn-down amount of the loan. For example, if you take out a $600,000 loan and the balance of the loan is $540,000 with $60,000 sitting in redraw or offset you will only receive a Shop Card to the value of $540,000, or Loan amount approved less any undrawn, offset, or redraw amount will be the value the shop card is issued at.

- The Costco Shop Card has no expiration date and cannot be exchanged for cash.

Delivery of Shop Card

The Costco Shop Card will be delivered electronically as a digital card via email from the Costco Services Team within 90 days of the loan settlement.

Detailed Terms and Conditions

For a comprehensive understanding of the terms and conditions governing the Costco Shop Card program, please visit Costco's website.

Book an

appointment

Complete this form with your information and book a suitable time for your dedicated broker appointment.

Our complimentary, no-obligation service provides expert guidance to help you make the best decision for your business.

Knowledge and support to manage your loans

At Manage Your Loans, we believe that the cornerstone of every successful financial journey is knowledge. We're not just here to offer loans; we're here to empower you with the insights and support you need to confidently navigate your loan management.

From the initial inquiry to the final paperwork, we ensure you're well-informed at every step, enabling you to make decisions that align with your best interests.

Our team of brokers is dedicated to guide you through the path ahead, unlocking possibilities you might have never considered.

Ready to discover new possibilities and take control of your financial journey?

Book an appointment with one of our brokers to start now.

Our process

Embarking on a financial journey can be daunting, but at Manage Your Loans, we've crafted a straightforward 10-step process that places you, our valued customer, at the forefront:

01. Begin with Trust: Start by signing our Credit Guide and Privacy Consent form, ensuring clarity and confidentiality.

02. Share Your Story: Complete our Online Fact Find, giving us insights into your financial aspirations.

03. Easy Uploads: Seamlessly upload all supporting documents via our secure platform.

04. Strategise with Us: Schedule a broker appointment for an insightful Strategy Session tailor-made for your goals.

05. Expert Recommendations: Your dedicated broker presents options best suited to your needs.

06. Making It Official: Agree upon and sign the Credit Proposal, a step closer to making your financial dreams a reality.

07. Application in Action: We submit your application, ensuring precision at every step.

08. Celebrating Approvals: Relish the moment as your application gets the green light.

09. Settlement and Success: Witness your application come to fruition as it settles.

10. A Token of Appreciation: As a cherry on top, receive your Costco Shop Card*, our way of saying 'Thank You'.

11. Ongoing Support: We are here to support you through your whole financial journey, our commitment to you doesn’t stop when the loan has settled.

* All digital Costco Shop Cards will be issued via email from the Costco Services team at least 90 days after the loan settlement. To be eligible for a Costco Shop Card, a valid Costco Executive Membership must be provided. For full terms and conditions, including relevant Costco Shop Card amounts and eligibility requirements, please visit www.manageyourloans.com.au/costco/

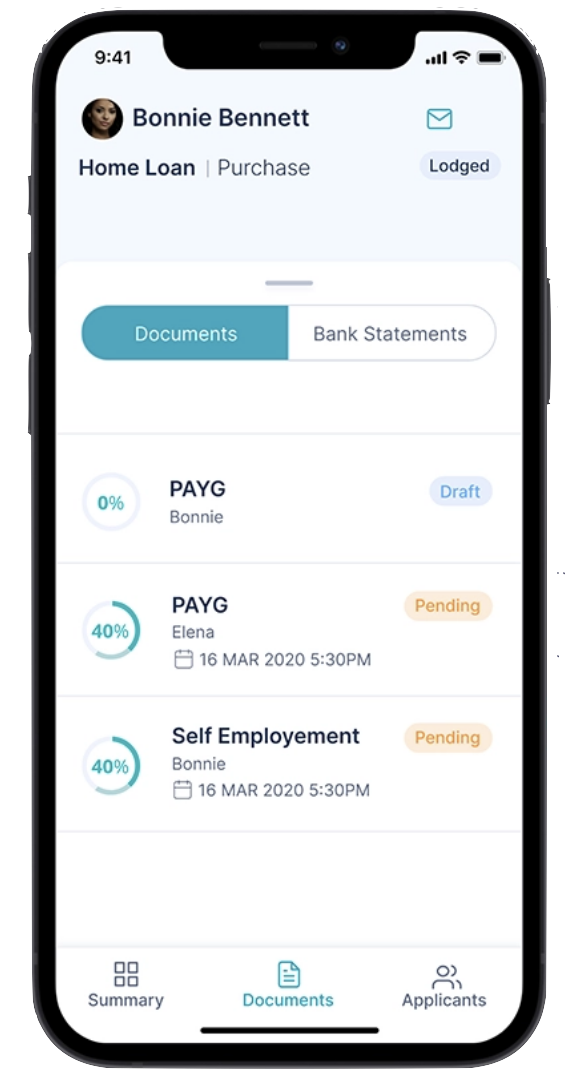

Make the right choice

We use smart tools that help you with your finances.

Our online portal keeps you up to date at all times.

The platform empowers you to navigate your loan application at your own pace, overseeing every step from document submission to settlement.

Book an appointment with one of our brokers to start the journey now.

FAQs

How much does it cost to consult Manage Your Loans?

There is no cost to you (the borrower) when taking on the services of an MYL broker. MYL typically earn a commission or fee from lenders for each successfully settled loan.

You are under no obligation to take a loan after reviewing options nor is there any cost involved for our customers.

How long does the loan approval process take?

It depends on the type of loan. For instance, home and car loans typically require collateral, while personal loans may be unsecured. Our loan representatives can provide specific information based on your chosen loan type.

What documents do I need to provide to the broker?

The specific documents required can vary based on the type of loan you're seeking and your individual circumstances. However, typically, for a mortgage, you'll be asked to provide the following:

- Proof of Identity: Photographic ID such as a driver's license, passport, or any other government-issued ID.

- Proof of Income: Recent pay slips (usually the last 2-3 months), tax returns, and possibly a letter from your employer detailing your employment status and income.

- Proof of Savings: Bank statements or passbooks showing consistent savings over a minimum period, typically 3-6 months.

- Details of Current Debts: Statements from credit cards, existing loans, and other debts.

- Proof of Current Living Expenses: This can include utility bills, rent receipts, or mortgage statements.

- Credit History Report: While brokers often access this on your behalf, it's good to have a personal copy for reference.

- Details of Assets: Information on properties, vehicles, investments, and other valuable assets you own.

- For Self-Employed Applicants: Business financial statements, business registration documents, and GST returns, among others.

- Proof of Deposit: If you've already made a deposit on a property or a purchase, you might be required to show evidence of this payment.

- Property Details: If you're seeking a mortgage or refinancing, you'll need to provide details about the property, including recent tax assessments, property details, or a purchase agreement.

How is my personal information protected with a broker?

At Manage Your Loans, the protection of your personal information is our utmost priority. We use advanced encryption techniques to ensure that the information you share with us electronically is safeguarded. This means that any data sent between you and our brokers is encoded and can only be deciphered by our secured system.

Only authorised personnel within our organisation have access to your data, and this access is strictly controlled and monitored. We provide regular training to our brokers and staff about the importance of maintaining data confidentiality.

We retain your personal data only for as long as it is necessary to provide you with our brokerage services, and for legal, regulatory, and legitimate business purposes. Once it's no longer needed, we securely destroy or anonymize it.

You have the right to know what personal information we hold about you and how it's used. If you have any concerns, you can request access to your data.

We only work with partners and third-party service providers who uphold the same stringent data protection standards as we do.

Always remember, while we take every step to protect your information, it's also essential to be vigilant when sharing personal details. Never share personal or financial information through unsecured channels or with unknown third parties. If you have any doubts or concerns about data protection, please do not hesitate to contact us.

Are the interest rates offered through a broker competitive?

Absolutely! At Manage Your Loans, our brokers have access to a broad range of lenders and loan products. We collaborate with numerous lenders, from major banks to smaller credit institutions. This breadth of choice allows us to find competitive rates tailored to your specific needs.

Rather than a one-size-fits-all rate, our brokers work diligently to understand your unique financial situation, goals, and preferences. This ensures that we can source rates that are not only competitive but also aligned with your long-term objectives.

With our industry knowledge and relationships, our brokers have the leverage to negotiate better rates on behalf of our clients.

We provide a clear breakdown of the rates, allowing you to compare and understand how they stack up against other offerings in the market.

While interest rates are a crucial factor, they are just one component of a loan. Our brokers also take into account other loan features, fees, and your broader financial picture to ensure you're getting a loan that's truly the best fit for you.

If you have questions or would like more insights into current rates, please don't hesitate to reach out to us.